Avance Gas has a fleet of 14 Very Large Gas Carriers (VLGC) mainly constructed in China and South Korea. Despite the full spot rate exposure in an abysmal market, the company will retain a robust liquidity position on our estimates ahead of improving fundamentals. Trading at a 18% discount to steel values at the current trough, we see Avance as a prime target for M&A. We initiate coverage with a BUY recommendation and target price of USD 28/sh (+36%).

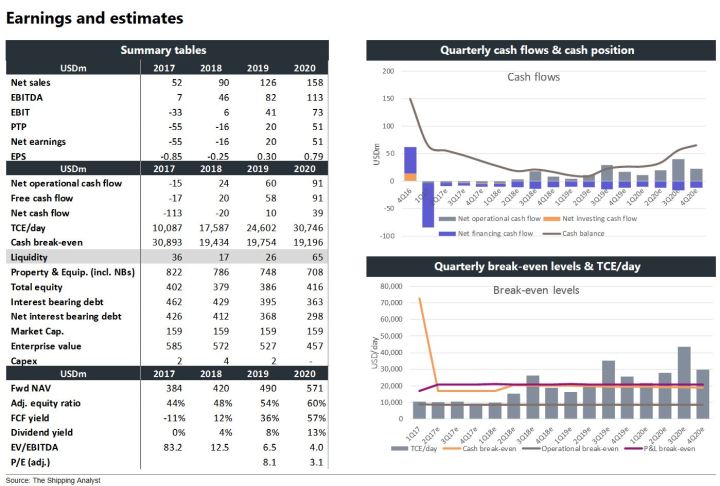

Valuation: We calculate a NAV of NOK 38/sh (P/NAV 0.55) after applying a USD 5m discount to the eight Chinese built VLGCs vs our generic South Korean based vessel values. Assuming asset prices rises 10% leads to a NAV of NOK 47/sh. Our target price of NOK 28/sh is based on a weighted average of current/future NAV and mid-cycle multiples in 2018/19E.

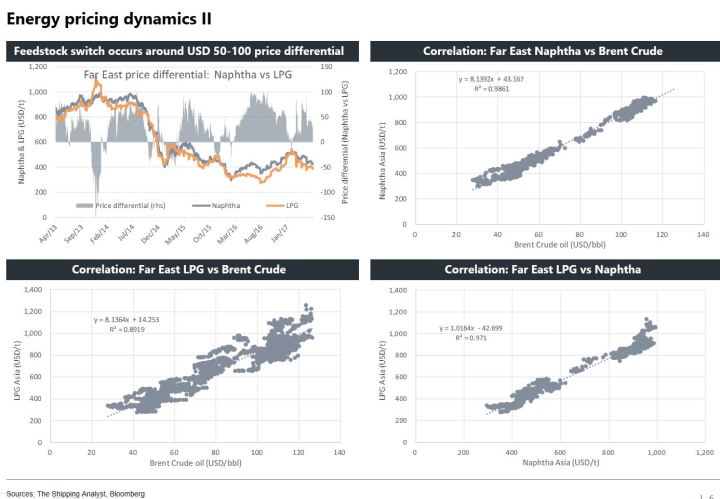

Market overview: Before the paradigm shift in 2014/15, LPG shipping on Very Large Gas Carriers (VLGC) had more industrial properties than today. The market was characterized by less spot activity, the Middle East as the main exporter and LPG prices primarily set to clear the market (supply driven). The US shale oil/gas boom, the collapse in oil prices and the massive expansion of US LPG export facilities have subsequently led to a market which is more spot cargo driven and dependent on the price differential between US and Asian energy prices being high enough for deep sea shipments of US LPG to make economically sense.

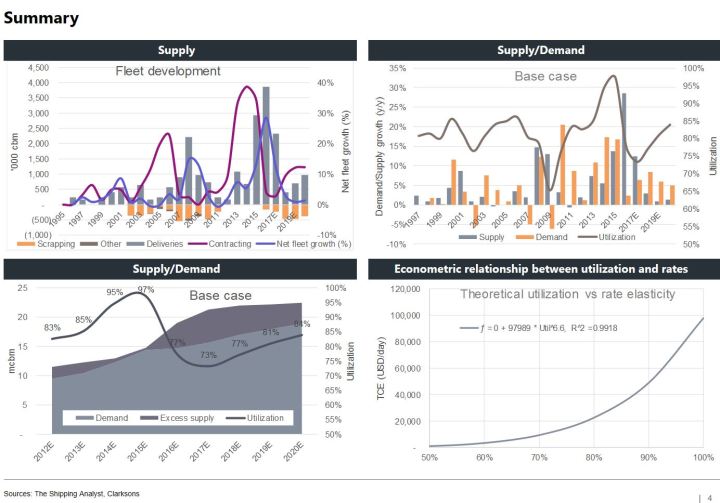

After enjoying super profits in 2014/15, VLGCs earnings collapsed under the weight of an extraordinary fleet growth from 164 vessels at the start of 2015 to 250 vessels today (CAGR of 19%), whereas demand has not kept up despite massive new US export capacity having de-bottlenecked the global trade. Lower global energy prices have also affected tonne-mile demand negatively, in concert with the expansion of the Panama Canal in mid-2016. Thus, we see two constraints that needs to be corrected before earnings once again can return to normalized levels and beyond: 1) The increase in global energy prices and 2) the reduction in the current tonnage oversupply.

The US rig count has risen 127% from the trough in mid-2016, representing increased present and future US shale oil and gas production. Hence, it is likely that excess LPG in the US will increase and prices will drop, increasing the LPG price differential vs the Far East, all else equal. However, the flip side of increased US production is lower global energy prices and thus lower LPG price differential. The optimal scenario would be high global energy prices and high shale production in the US, but this is not a base case scenario in our view. An increased LPG price differential is pivotal for making LPG shipments on VLGCs economical viable, with current theoretical TCE rates at USD -7k/d (vs USD 120k/d at the peak in mid-2014). Based on the current Brent crude oil futures curve, and assuming unchanged US LPG prices, we estimate VLGC rates below USD 10k/d until 2020E. However, elevating the futures curve by a mere USD 10/bbl to around USD 60/bbl enables theoretical VLGC rates around USD 40-50k/d. This shows how sensitive spot rates are to global energy prices. Overall, we forecast demand growth of 6% in 2017E, 8% in 2018E and 6% in 2019E (vs 6% average since 1999) based the new US export capacity coming online, a small increase in global energy prices and unchanged or falling US LPG prices.

In terms of supply growth, we are still seeing deliveries from the massive contracting during the 2014/15 super-cycle (current gross orderbook at 13% vs fleet). Given the lacklustre earnings and 17 vessels older than 30 years (6% of fleet), it would be natural to see significant scrapping at this point. However, we have only seen two vessels sent to the beaches over the past year, but we still believe scrapping to pick up going forward. Nevertheless, zero newbuildings have been contracted over the past year, thus laying the foundation for the next expansionary phase in the cycle. We forecast net supply growth of 12% in 2017E, 3% in 2018E and 1% in 2019E.

In sum, we expect utilization to trough at 73% in 2017E, recover to 77% in ’18E and rise to 81% in ‘19E. This equates to average VLGC spot rates of USD 13k/d in 2017E, USD 18k/d in ‘18E and USD 25k/d in ‘19E.

Company specifics:

Market fundamentals:

BW is better among VLGC (better build quality thus resale value and in better shape). The best play in LPG remains, despite its volatility, NVGS.

LikeLiked by 1 person

Thanks for an interesting article with great charts (Any regular update to those would be great and very valuable).

As US natural gas production and infrastructure grows I would hope LPG prices fall in the US faster than the oilprice does.

Happy I found this blog.

LikeLiked by 1 person

Thanks for the comments.

An initiation on BWLPG/Dorian might be natural next step. NVGS might be further out in time. Historically, I have found the pricing of the latter to be a bit fresh and too much value given to the potential VLECs. However, I haven’t done the math in a couple of years…

We will aim at updating our LPG charts on a quarterly basis, without committing to anything.

LikeLike