Flex LNG announced earlier this week the purchase of two MEGI LNGC newbuildings from Geveran (Mr. Fredriksen) at USD 180m apiece, which we view as attractive vs our generic valuation at USD 194m and as we see significant upside in asset prices over the next few years. The payment structure is 20% on completion of the private placement (see below) and 80% upon vessel delivery. The company has simultaneously raised USD ~125m in new equity by issuing 89.5m new shares at NOK 12/sh, with a a subsequent repair issuance initially planned towards existing shareholders not partaking in the private placement, but later cancelled as the share price was trading below NOK12/sh.

The accretive fleet growth is in line with our expectations as highlighted in our FLNG-NO: Initiation (BUY, TP 17), and will further add to share free-float/liquidity and focus from investors/analysts. The company is also “exploring the potential migration of its listing from Oslo Axess“.

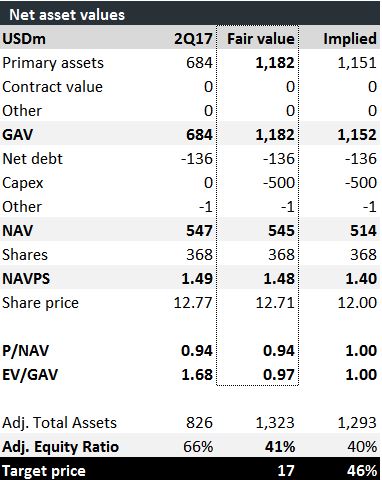

The accretive transaction raises our NAV/sh from USD 1.37 to USD 1.48 (NOK 12.7), but our TP based on a weighted average of current and future NAV, in combination with a mid-cycle EV/EBITDA in 2019E, remains unchanged at NOK 17.

Update: The initial subsequent offering to shareholders as of 26 April was cancelled due to the share price trading below the subscription price of NOK 12/sh, but the company has decided that shareholders as of 16 February 2017 shall receive the right to subscribe to 0.80922 offer shares per share held, equating to a potential 7.2m new shares.

In our view, shareholders as of 26 April have lost the optional value embedded in the initially announced subsequent offering, while investors as of 16 February have been granted a similar option.

http://www.newsweb.no/newsweb/search.do?messageId=426712

LikeLike