We initiate coverage of Ensco with a BUY recommendation and target price of USD 17

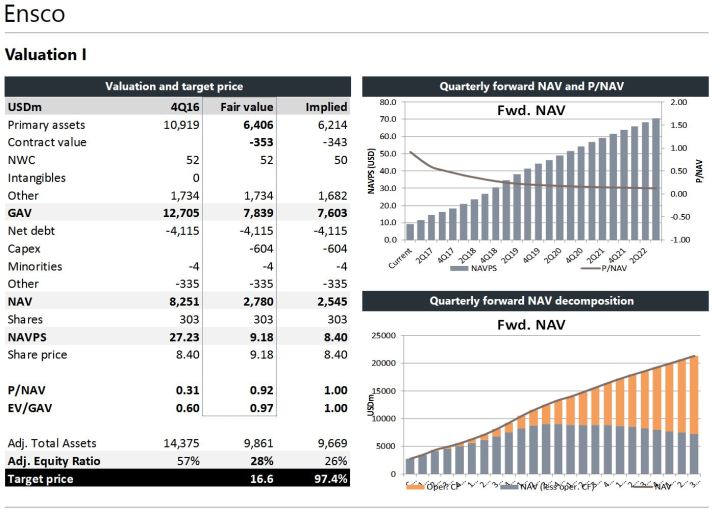

The company has 59 rigs on the water in addition to two deferred newbuildings, a market cap of USD 2.5bn and is on of the most liquid names in the industry. Despite this, we estimate the company is trading at a discount to NAV and an implied 3% discount per rig at current trough levels.

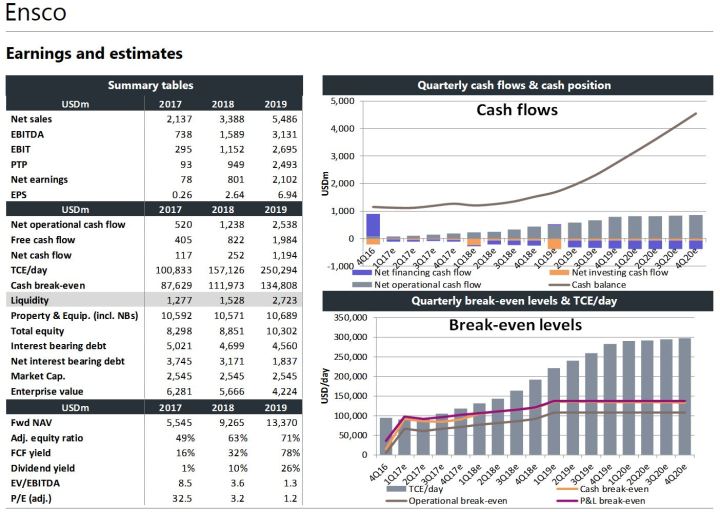

The company is in a strong cash position with USD 1.2bn at hand as of end-’16, and could potentially play the role as consolidator in a market where several household names are in financial disarray.

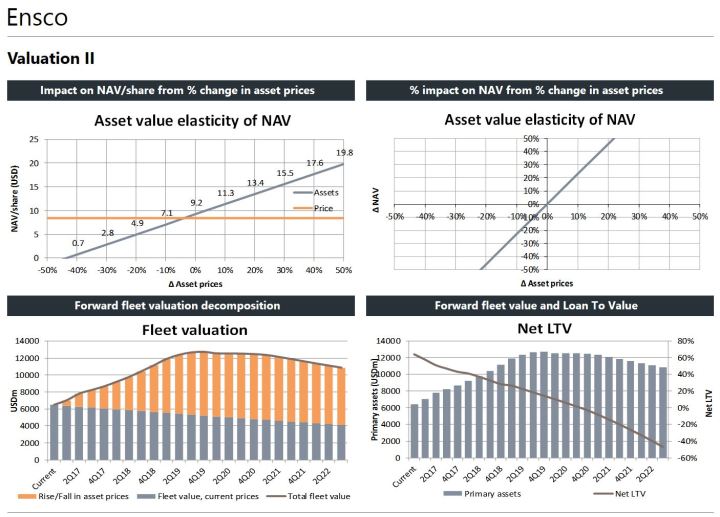

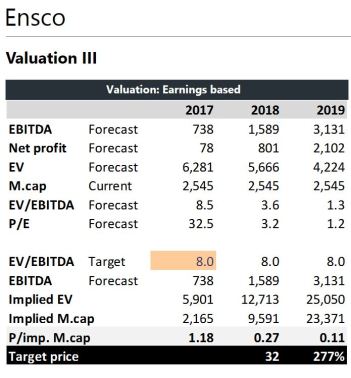

Valuation: We pencil in a 35% appreciation of asset values to reach our target price of USD 17/sh, with further support lent from a mid-cycle EV/EBITDA valution in 2018E at USD 32/sh.

Company specifics:

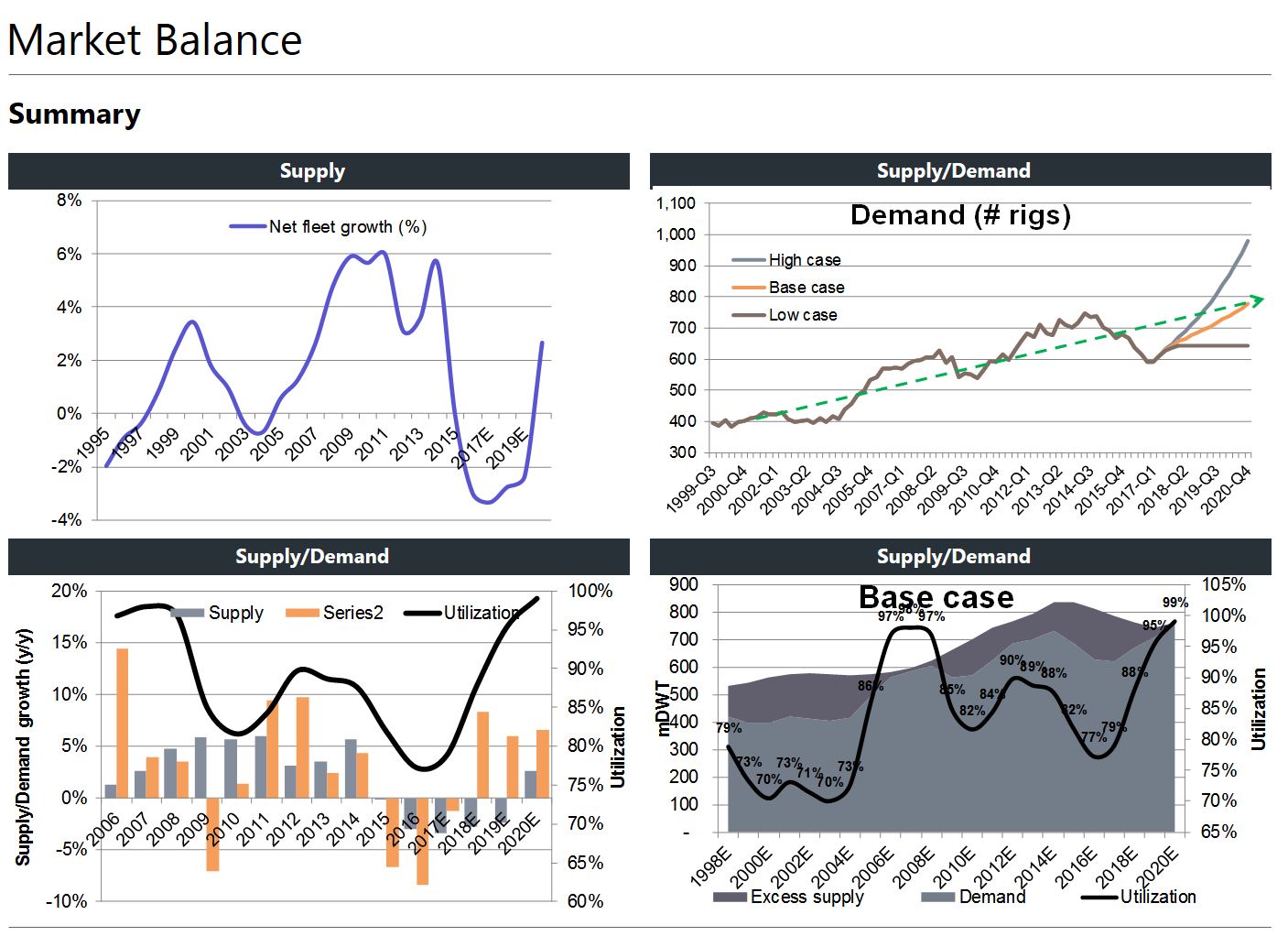

Market fundamentals:

One thought on “ESV-US: Initiation (BUY, TP 17)”