We initiate coverage of GasLog with a BUY recommendation and target price of USD 18.

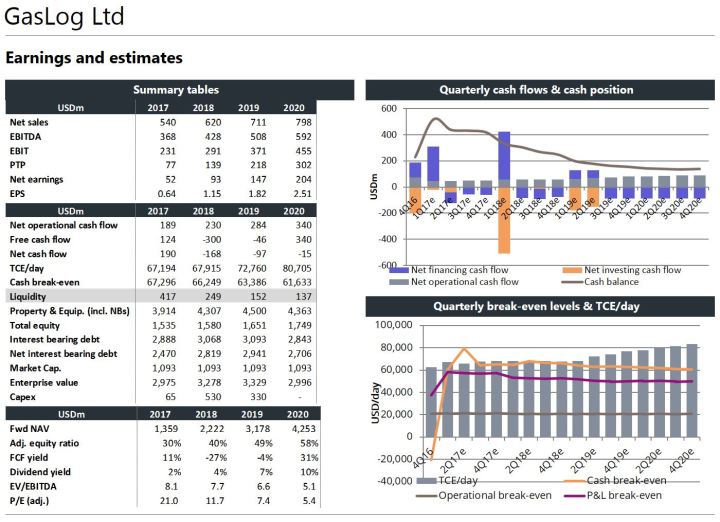

The company has a fleet of 27 LNG Carriers (including five newbuldings) with a contract coverage of 76% in 2017 and an average minimum back-log per contracted vessel of ~5.5 years. Although the secured cash-flow enables the company to pay dividends even at the trough (current annualized dividend yield at 8%), it also equates to less operational leverage at what we believe to be the expansionary point in the cycle from mid-’17. Furthermore, GasLog is exploring possibilities within the booming FSRU segment, and has an attractive source of financing trough its MLP (at least in the current environment of low interest rates). We find low risk and great valuation in GasLog and initiate coverage with a BUY recommendation and TP of USD 18.

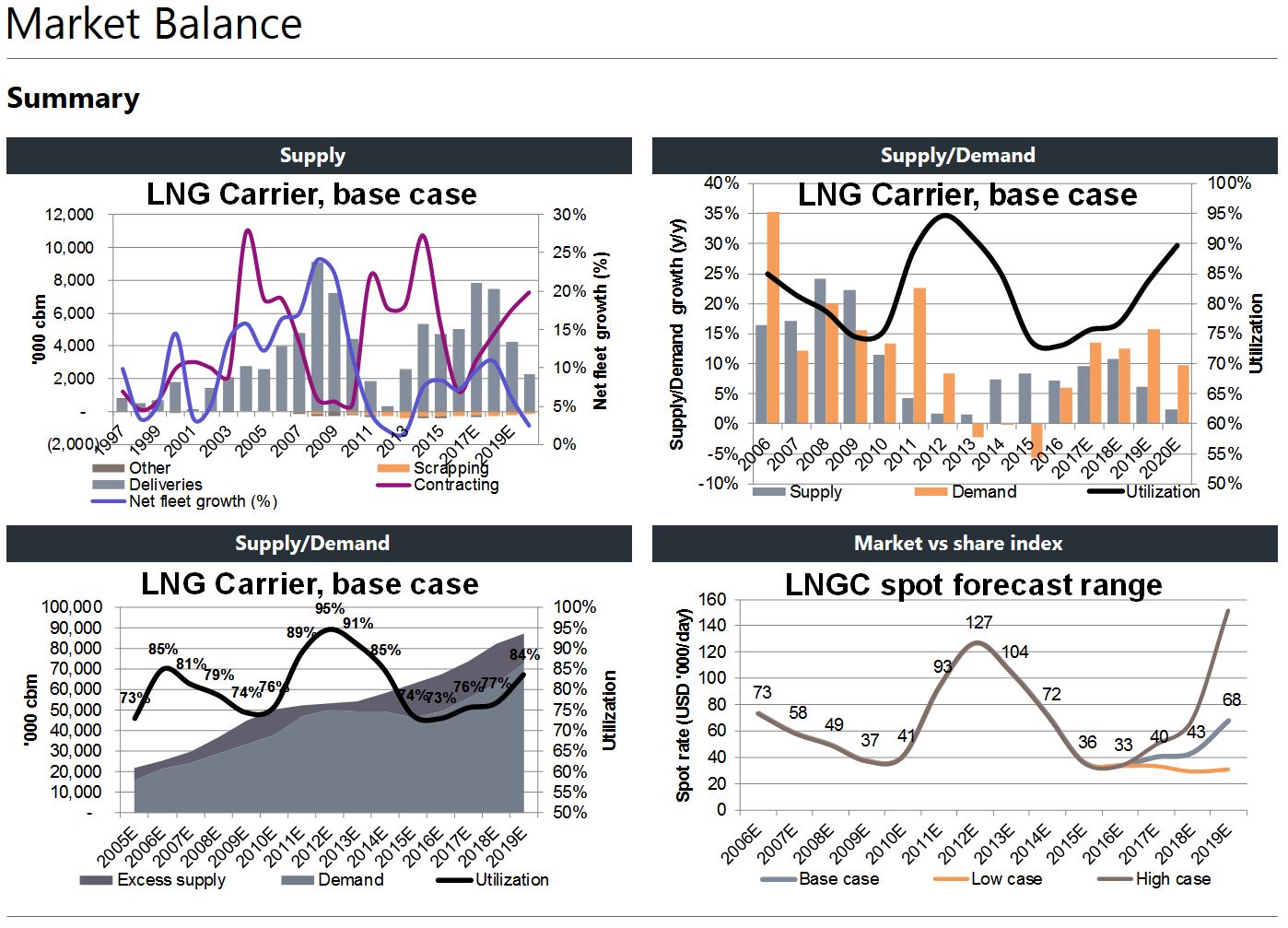

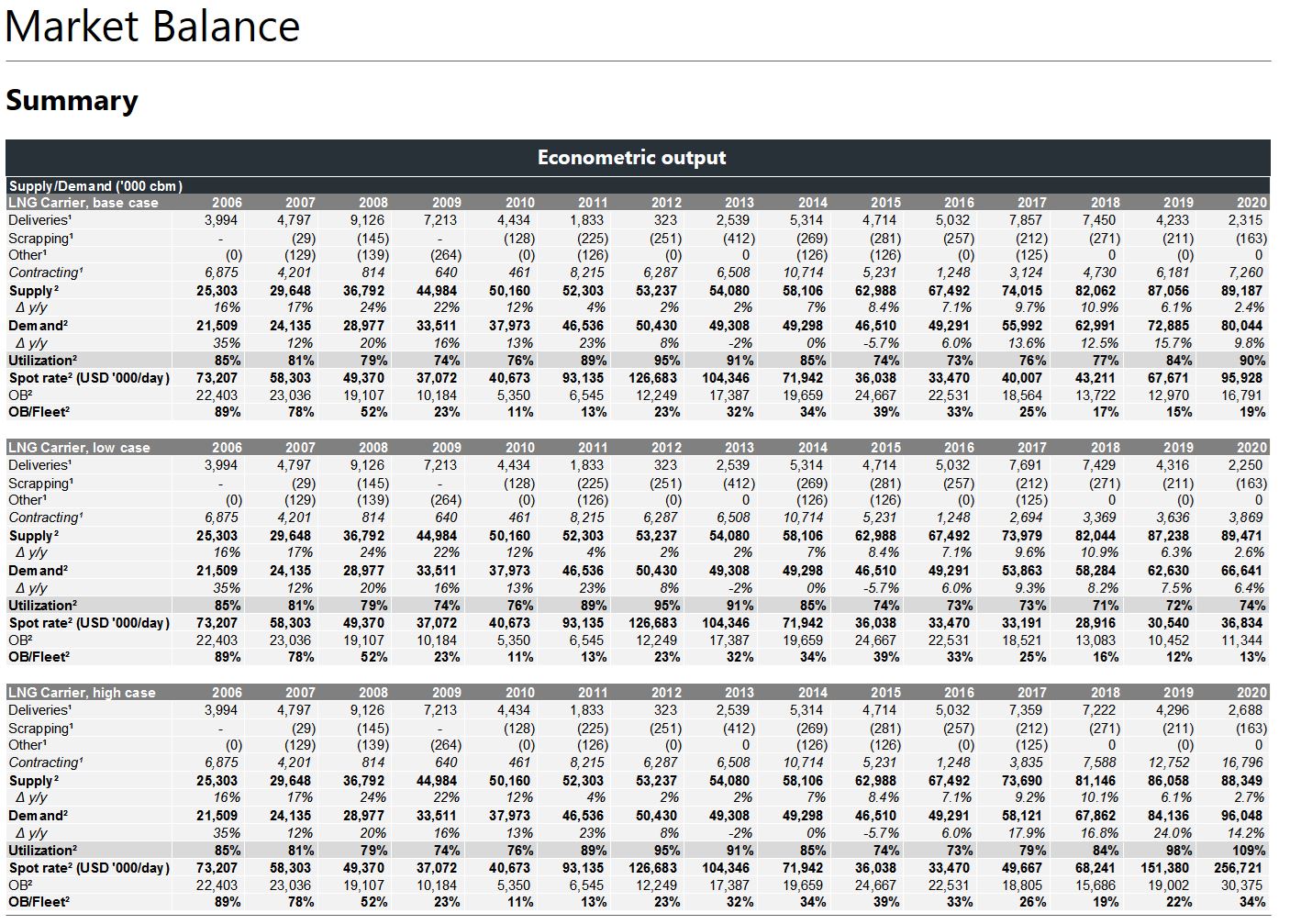

Market update: 17 LNGCs are scheduled for delivery in 2q17 (adjusted for FSRUs), representing a staggering fleet growth of 4% in just one quarter. Depending on slippage, the orderbook less our estimated scrapping implies a quarterly net fleet growth of 2-4% until and including 1Q19, or around 10% annualized in 2017E and 2018E. Although concerning, the supply growth is more than offset by our demand forecast of 14% in 2017E and 13% in 2018E, leading to improving utilization ahead. However, looking at the history, LNGCs have usually been delivered in a timely matter, but LNG export projects have not. Thus, although our base case is for improving utilization, earnings and asset prices ahead, we will be watching project developments closely.

Given the weak seasonality of spot rates in 2q (May historically the low), we believe that the next months could offer an opportunity for the LNGC-hungry investor to increase exposure, ahead of what will eventually be better times for LNG shipping.

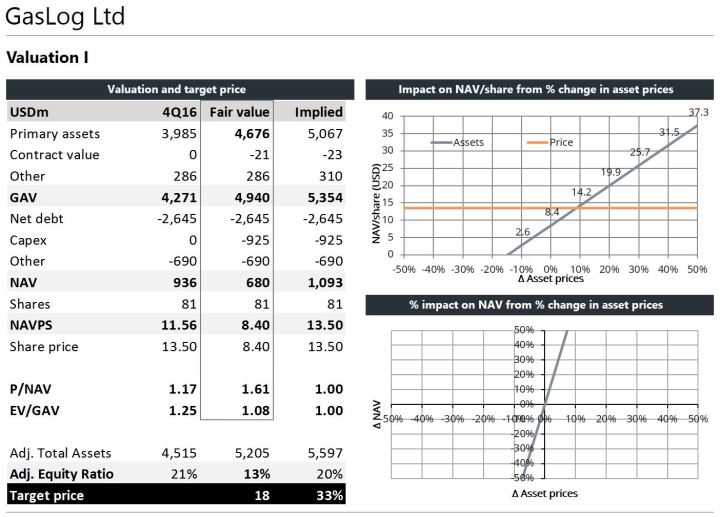

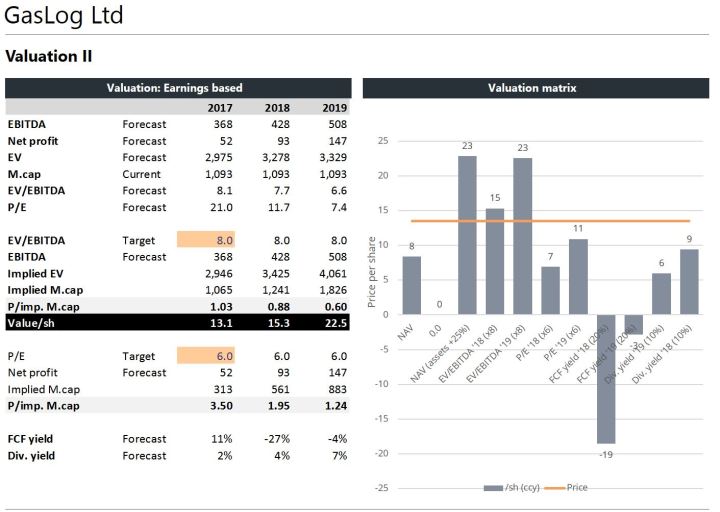

Valuation: Our target price of USD 18/sh is based on a weighted average of current and future NAV, in combination with a mid-cycle EV/EBITDA in 2018E/’19E.

Company specifics:

Market fundamentals:

One thought on “GLOG-US: Initiation (BUY, TP 18)”